Picto Diary - 01 to 08 January 2024 - Elaine Jorgensen

Above: Deer Valley, Park City, UT. 01 January 2024.

13 14 107

Good way to start the new year!

Paid for Mark's coffee at Stein Eriksen in return for valuable ski tips. Irregular, now crunchy, now icy surfaces. Need for good leg strength to ski these unpredictable conditions, where, effectively, no snow has fallen for over a month.

Above: Park City Mountain Resort. Park City, UT. 02 January 2024.

14 09 116

Bishop 'n Espresso.

Above: Iron Canyon, Park City, UT. 02 January 2023.

Devon, Allon, Val D'Isere, Espresso, with TIMDT. Visiting friends from the UK, Devon and sons whipped up some good grub during their stay with TIMDT and Mwah (sic).

Above: Park City Mountain Resort. Park City, UT. 03 January 2024.

15 07 123

Busy, busy. Skiing with Val d'Isere and Allon. At least a bit of new snow.

Above: Elaine Jorgensen. Ephraim, UT. Dec 23 1939 to Jan 3 2024. 03 January 2024.

Elaine Jorgensen Obituary 2024 - Magleby Mortuary

The Monk called this AM to notify that Elaine had passed quietly in the night. We are so blessed to have had friends like The Monk and Elaine, at once talented, selfless, generous and successful as parents and in life. Elaine gave up a top of the heap musical career as a Julliard trained flutist to join The Monk in an international banking career, interspersed with an LDS mission presidency in Milan. Post professional life, Elaine and The Monk "retired" to the pastoral life as ranchers. Throughout her peripatetic existence, Elaine earned the love and respect of thousands and bore five children whom she and The Monk raised, all, to successful adulthoods. She kept working on her flute on the side and taught hundreds of aspiring flutists as a private teacher and as an adjunct professor at the Jorgensen family endowed Horne School of Music at Snow College. In the next life, Elaine is in the inner circle.

Above: Nice Neighbors. Iron Canyon. Park City, UT. 04 January 2024.

Above: Iron Canyon. Park City, UT. 04 January 2024.

Hanging out at home on a grim winter day.

Above: Wasatch Bagel. Park City, UT. 05 January 2024.

LSDM Friday AM Colloquium.

Topics:

Harvard, DEI, and Claudine Gay

Wasatch Peaks. New hurdles.

Property owners sue Wasatch County

Park City City Council investiture.

Local incest/rape case.

Check ins on recent member travels.

City leaders weighing in on global politics. Part of their role?

LSDM members' scions: Rory, el Contadore's son, visiting from London. Pursuing Masters in art commerce.

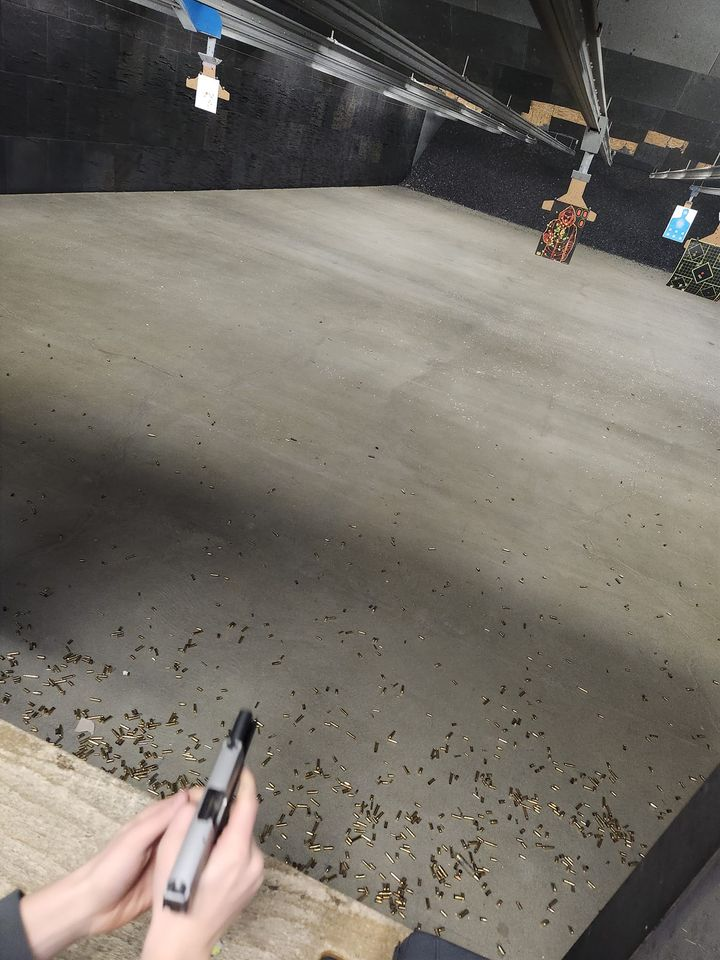

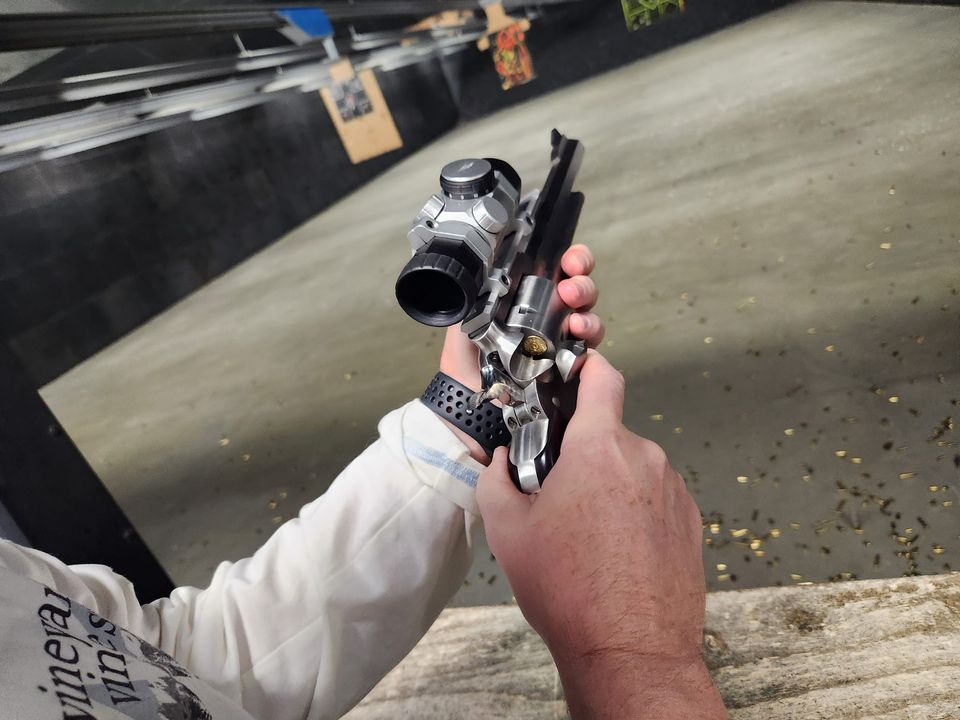

Above: Park City Gun Club. 07 January 2024.

Don't ski. Shoot!

Well attended shoot included Mwah (sic), B1B, Drums, Devon, Val d'Isere, and Allon.

We fired six weapons:

Sig Sauer P365 nine-millimeter (first image above). Favored side arm of Navy Seals.

454 Casul (second image above). Five chamber revolver disfavored by elk everywhere.

Ruger 38 police special

HK 45 semi auto pistol.

Sig Sauer AR-15.

Remington six chambered, semi-auto tactical shot gun.

Above: Koessler Family. Iron Canyon. Park City, UT. 07 January 2024.

Chinese food! Grrr and Z measured. Each gained an inch since November 2023. Roy missing this impromptu image, but she's somewhere around.

Addendum

Steve, Thank you for sending this concise and absolutely spot-on assessment. I was just in the process of sending the same, from your year-end post, to my family. Your zest for life is inspiring! I look forward to your musings. Thank you.

Mark,

San Francisco, CA

Please remove my address from your group list. I disagree with every single one of your predictions for the future of the world. You must watch Fox "news".

Academy Theater,

Salt Lake City, UT

I really wish I could disagree with you on this, but I can't. Even if one of the listed candidates makes it into office, the undertow of the swamp is making positive change very difficult.

John Galt,

Walla Walla, WA

You forgot 'bad boys' USA and UK ?

Forever wars and the MIC . . .

Mano,

San Jose, CA

Good summary and on point.

The Archbishop,

Naples, FL

Let's ponder this a moment...

1) Debt/GDP. The book which essentially framed modern capitalism wasn't called Annual Gross Domestic Product of Nations, it was called Wealth of Nations...and I think there is a valuable lesson in there. This is very similar to bank lending practices. When you have a borrower without much history or assets, Debt/Income and Payment/Income are the only tools you have to work with. But once a customer has assets/wealth, then it is more likely you will look at asset-based lending. Asset-based lending is inherently less risky because you can ascribe value to assets, haircut those values and have some security behind the loan...much less risky than hoping one keeps their job. So, with that in mind, consider the following:

The US household net worth currently stands north of 150 TRILLION dollars, nearly six times our annual GDP. What's more, the assets behind that net worth tend to appreciate over time, so we have an inflation hedge (Imperial Palace issue notwithstanding...but we are NOWHERE close to 1980s Tokyo)...whereas we mostly borrow in nominal terms. What's more, if we have the resolve, we can harness our taxing power to reduce debt if we really want to. But household net worth in the US has never been higher, notionally or as a percentage of GDP.

2) The Fed has indeed expanded its balance sheet since the GFC...but they've become a pretty integral part of our finance system--largely because of the GFC. There are less players/market makers in government debt, banks have shrunk/curtailed some of their balance sheet activities--namely repo books, so the Fed via the ON RRP facility has become pretty instrumental in the money markets (especially with 6 trillion flowing into MMFs this past year). This is ongoing, the only quick fix would be to roll back regs to the point they were pre-GFC...but not sure we really want to replay that one....so instead the gradual approach will remain.

Now, for the second part of this...I'd really like to know the source of your data that real wages increased by 15% in 1981. Real wages have more or less stayed in a fairly tight band since 1980 between +/- 5%, with lion's share being +/- 2.5% over that time. (The only outlier was the whipsaw during the pandemic, but that was a quirk because lower paid service workers were laid off and those higher paid workers who could WFH skewed the pool of wage earners.) But inflation was high in 1981, so perhaps you may be confusing nominal versus real? (There was a dubious source on the internet who was making such a mistaken claim either because they themselves were confused, or they were just trying to pick off the slow deer.) This is important because if you are suggesting policy based on flawed information, you probably will come up with a flawed solution.

BUT--since you are concerned about the middle class, I would suggest that it wasn't necessarily the Fed policies which have cause inequality distortions (indeed, some--but not all-- studies suggest wealth inequality mellowed post GFC), but instead our tax policy. People often conflate taxes with capitalism, when it is far more nuanced than that. Take a look at the following graph. Somewhere around 1990 or so, real median wages and productivity stopped tracking. One could be higher specialization (education) needed in the information economy, robotics on the production line, etc. But we also had begun preferencing capital to labor. So, capital began collecting more of the benefits. Taxation is a means to adjust for these imbalances...if indeed you are serious in your concern for the middle class. Go back to chart one and see how much household net worth has grown...then ask yourself why we tax income (which for most people is the first step to accumulating wealth) at higher rates than capital? We give a break to those who have already made it. FICA taxes fall off before income tax brackets rise, the Warren Buffett and his secretary issue, etc. If you want to help the national budget and look out for the middle class, then we should probably address this. But only if you are serious about it.

3) Border control. Don't even know where to begin here, other than there are 12mm unlawful immigrants in this country, or about 3% of our population. Half of those were people who entered legally but overstayed their visas. Studies are inconclusive as to what the "cost" is--but those put out by fear mongers tend to focus on only one side of the ledger...most likely, it is a push. If you want the economy to grow, we need to add worker-hours (and productivity).. Boomers are net retiring and prime age workforce participation remains near all-time highs.

4-8) On power projection, education, demographics and democracy...ask yourself seriously if you are part of the problem or the solution. Supporting book banning, denigrating higher ed, being unwelcoming to immigrants and waffling on our allies seem to suggest the former, not the latter.

5) Decline of religion. Hey, we used to believe in phlogiston. Ok, seriously, in this country we are free to believe, or not believe, in whatever the hell we want. I thank God every day that I do not live in a theocracy... . But if you think Trump or Ramaswamy is your ecclesiastical North Star, then I suggest going back to Sunday School.

Eric,

Seattle, WA

Fish,

Santa Barbara, CA